Do you take credit cards at your business or run an online store? Chances are, you’ll be receiving a 1099-K form for your tax reporting.

What is it? What do you do with it? What are the important things to keep in mind? All of these questions will be answered in this post.

What is a 1099-K? A Brief History

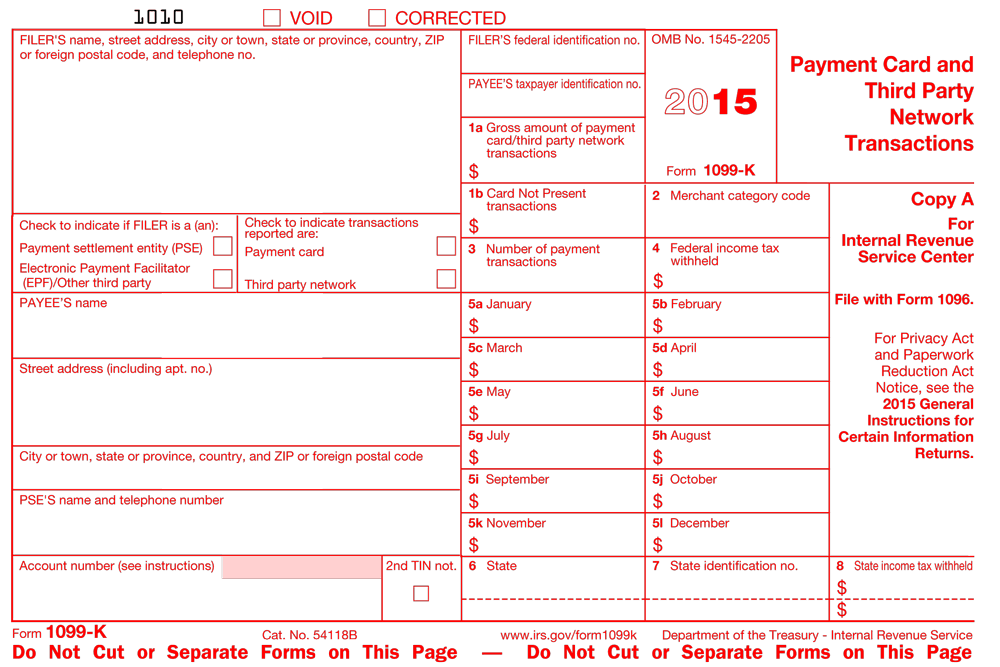

The 1099-K for small businesses was approved in 2008 and began making an appearance in the 2011 tax year. (Oddly enough, it was snuck into the 2008 Housing Assistance Tax Act, despite being unrelated to housing.) Officially known as the “Payment Card and Third Party Network Transactions”, the IRS created the form as a way of encouraging more accurate reporting of income from small businesses.

When do I receive a 1099-K?

The 1099-K form is sent to you by your processor, whether it is a credit card processor (merchant account provider) or an online retailer such as PayPal, Amazon, or Etsy (these count as third party network transactions). Now, the third-party network transaction part matters. If you’re only using a PayPal store and don’t have a terminal you run transactions through, you will only receive a 1099-K if you have processed at least $20,000 and run at least 200 transactions in the calendar year for that specific processor. A credit card processing company sends you a 1099-K form regardless.

Either way, the 1099-K should arrive in January and reports your gross annual sales that have been processed with cards in the previous year, which you add into your profits and overall income reporting on your taxes. It will also come with a breakdown of transactions by month.

“The 1099-K does NOT account for refunds, chargebacks, gift card purchases, and cash back…if you have a lot of returns or chargebacks, you could be paying too much in taxes unnecessarily.”

Now before you completely fall asleep, this is the point where your teacher slaps the ruler on your desk and tells you, “pay attention, this is important!” The 1099-K does NOT account for refunds, chargebacks, gift card purchases, and cash back. What does that mean? Well, it means that if you have a lot of returns or chargebacks, you could be paying too much in taxes unnecessarily.

That is why it’s a very good idea to keep a strict record of the differences between electronic transactions you made money on (purchases), and those that you did not (refunds, cash back from debit, chargebacks, etc). It has the potential to save you a lot of money and will make your reporting more accurate.

I got a 1099-K for processing payments. What do I do now?

Well, you pay your taxes. Duh. Really, though, it will not affect the amount of tax you owe (unless you were hiding profits, which you shouldn’t be doing anyway). You should make sure that the sum of all of your 1099 forms and gross transactions do not exceed your total profits and account for any reductions such as refunds, as I mentioned above. The amount on your 1099-K is added to the gross profits for the year and is really just a way for the IRS to get a more accurate picture of what you made.

|

| This is what a 1099-K form looks like, just in case you were wondering. |

Time for a Quiz!

Here’s the scenario: Betsy has an eBay store and processes all of her transactions through PayPal. She ran 150 online sales last year and made $30,200. She also has a brick and mortar store which she uses a merchant account provider to process for. She ran about 190 sales last year and made $7,000. How many 1099-K forms will she receive, and from whom? What will she have to report?

Answer: She will only receive one form from her merchant account provider unless PayPal is feeling especially generous. PayPal, which counts as a third party network processor, is not required to send her a 1099-K because she ran less than 200 transactions throughout the year, even though she made more than the $20,000 limit. However, she still has to report the sales to the IRS in her gross profits, there’s just no official form outlining how much was sold. Pretty confusing, huh?

In conclusion, the 1099-K form, like many tax-related items, can be confusing if you don’t understand what to look for. However, by reading this post hopefully you have gained a better understanding of what a 1099-K is for, and when you will receive one.

Below are several resources for you to look at if you feel like diving in further. Happy profit reporting!

Official Instructions for the 1099-K from the IRS

Form 1099-K Reporting Requirements from the IRS

Understanding Your 1099-K Form

FAQs About Payment Card and Third Party Network Transactions