So you want to take credit cards at your business or you already accept them but you are looking to switch processors. That means you need to apply for a merchant account to do so. Before you jump into an agreement, though, it’s good to know a little bit about the application and the process.

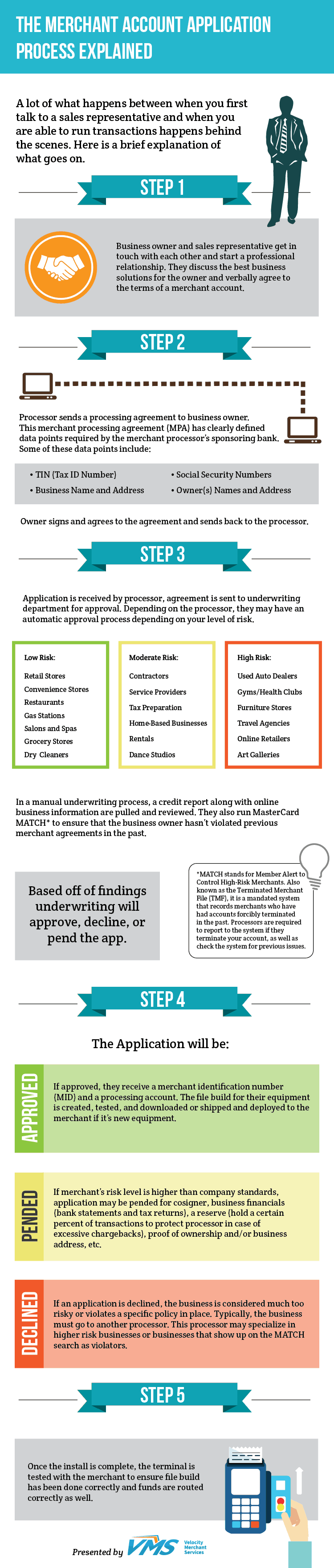

A lot of small business owners have applied for a merchant account before, but what goes on behind the curtain? It’s a bit complicated, so we created this post (and attached infographic) spell it out for you.

The Merchant Application Process

Although the infographic goes more in depth, here is a brief version of the process:

1. Business relationship is formed. Business owner is interested in getting an account.

2. Merchant Processing Agreement (MPA) is sent and signed.

3. MPA and information are sent to the underwriting department.

4. Account is either approved, denied, or pended based on several factors.

5. Account is opened, equipment is installed, and processing begins.