Author: Jackie Navarrete (The Logistician)

Payment expectations have changed. Customers no longer want to wait on invoices, download apps, or return calls just to complete a payment. They want simple, immediate options that work on the device already in their hand.

That is where text to pay becomes a powerful tool for small businesses.

Text-to-pay allows a business to send a secure payment link via SMS, enabling customers to complete a payment instantly from their phone—no login, no app, no friction. When implemented correctly, it shortens payment cycles, reduces manual follow-up, and improves overall cash flow.

This guide explains how text to pay works, which businesses benefit most, how to implement it safely, and what to look for in a compliant system.

(For a general overview of modern payment tools, see

➡️ https://www.getvms.com/payment-processing/)

What Is Text to Pay?

Text to pay is a payment method that allows a business to send a secure payment request via SMS. The message contains a unique payment link that opens a mobile-friendly checkout page where the customer can pay by credit card, debit card, or digital wallet.

Key Characteristics of Text-to-Pay

-

Payment request sent via SMS

-

Secure, tokenized payment link

-

No app download required

-

Works on any smartphone

-

Payment completed in seconds

Text-to-pay is not a replacement for in-store payments or online checkout—it is an extension that fills gaps where traditional payment methods are slow or inconvenient.

Why Text to Pay Is Growing Among Small Businesses

Small businesses often struggle with:

-

delayed invoice payments

-

missed phone calls

-

unpaid service balances

-

customers “forgetting” to pay

-

manual payment collection

Text-to-pay directly addresses these issues.

Operational Benefits of Text to Pay

-

Faster payments

-

Reduced days sales outstanding (DSO)

-

Fewer follow-up calls and emails

-

Improved customer experience

-

Lower administrative workload

-

Higher payment completion rates

Because SMS open rates exceed 90%, text to pay dramatically outperforms email-based invoicing for speed and response.

Which Small Businesses Benefit Most from Text to Pay

Text-to-pay works especially well for businesses that bill after a service is provided or operate outside a traditional checkout environment.

Common examples include:

Service-Based Businesses

-

HVAC

-

plumbing

-

electrical services

-

auto repair

-

mobile mechanics

-

cleaning services

Healthcare & Professional Services

-

medical offices

-

dental practices

-

chiropractors

-

therapists

-

legal offices

Retail & Specialty Businesses

-

custom orders

-

deposits for high-ticket items

-

special orders

-

phone orders

Restaurants & Hospitality

-

catering invoices

-

event deposits

-

private dining balances

Multi-Location and Remote Businesses

-

franchises

-

field service teams

-

sales teams collecting deposits remotely

For these businesses, text to pay closes the gap between service completion and payment.

How Text-to-Pay Works (Step-by-Step)

A compliant text-to-pay workflow follows a structured process:

Step 1: Create the Payment Request

The business generates a payment request through their POS system, virtual terminal, or payment dashboard.

Step 2: Send the Secure SMS Link

The system sends a text message containing a one-time payment link to the customer’s phone number.

Step 3: Customer Opens the Link

The link opens a secure, mobile-optimized checkout page.

Step 4: Customer Completes Payment

The customer enters payment details or uses a saved digital wallet.

Step 5: Payment Is Processed and Confirmed

Both the business and customer receive confirmation.

This entire process typically takes under one minute.

Text to Pay vs Other Remote Payment Methods

Understanding how text-to-pay compares to alternatives helps clarify its value.

Text to Pay vs Email Invoicing

-

SMS has significantly higher open rates

-

Faster response time

-

Less likely to be ignored

Text to Pay vs Phone Payments

-

No manual card entry

-

Reduced PCI risk

-

No call scheduling

Text to Pay vs Payment Apps

-

No app download required

-

More professional appearance

-

Integrated into existing payment systems

For small businesses, text to pay offers the best balance of speed, professionalism, and simplicity.

Security and PCI Compliance Considerations

Security is non-negotiable when collecting payments remotely.

A compliant text-to-pay solution must include:

-

Tokenized payment links

-

Encrypted data transmission

-

No card data stored on devices

-

PCI-compliant gateways

-

Expiring or single-use links

Businesses should never request card numbers via text message. The SMS should only contain a secure link to a hosted checkout page.

For official PCI standards, reference:

➡️ https://www.pcisecuritystandards.org/

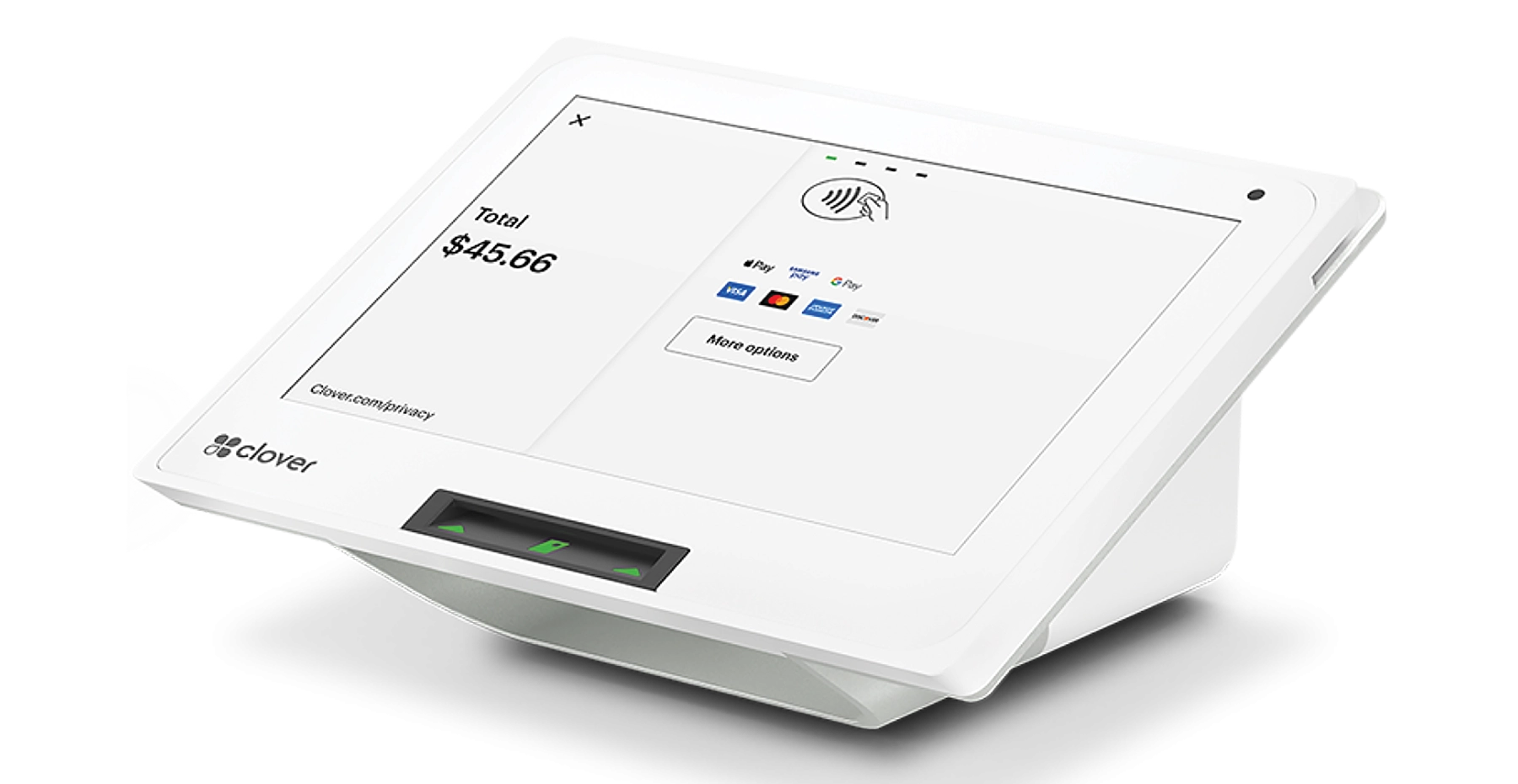

POS and Payment System Requirements for Text to Pay

Not all payment platforms support text-to-pay correctly.

A suitable system should:

-

Generate secure payment links

-

Support SMS delivery

-

Integrate with existing POS or virtual terminal

-

Sync payments with reporting and reconciliation

-

Allow payment descriptions and invoice references

-

Support partial payments or deposits

Modern POS systems and gateways—when configured properly—can support text to pay as part of a broader omnichannel strategy.

For POS compatibility considerations, see:

➡️ https://www.getvms.com/what-is-a-pos-system/

Text to Pay and Customer Experience

From the customer’s perspective, text-to-pay offers:

-

convenience

-

speed

-

minimal friction

-

flexibility to pay immediately

Customers do not need to:

-

download an app

-

create an account

-

log into a portal

-

wait on hold

This ease of use often leads to faster payment completion and fewer disputes.

Common Use Cases for Text to Pay

Deposits

Send a text-to-pay link to collect deposits before work begins.

Balance Due After Service

Technicians or staff can send a payment link immediately upon job completion.

Missed Payments

Replace reminder calls with a simple text message.

Remote Sales

Collect payment when the customer is not physically present.

Event and Catering Payments

Send final invoices via text for immediate settlement.

These use cases significantly reduce collection delays.

Text to Pay for Multi-Location Businesses

For businesses with multiple locations or mobile teams, text-to-pay adds consistency.

Benefits include:

-

centralized reporting

-

standardized payment workflows

-

reduced location-level discrepancies

-

faster collections across regions

Text-to-pay integrates well with centralized payment systems used by franchises and regional operators.

(For more on centralized payment strategies, see

➡️ https://www.getvms.com/multi-location-payment-processing/)

Legal and Communication Best Practices

When using text to pay, businesses should follow SMS compliance standards:

-

Obtain customer consent to receive texts

-

Clearly identify the business in messages

-

Avoid excessive messaging

-

Include payment context (invoice number or description)

For guidance on SMS communication standards, see FTC guidance:

➡️ https://www.ftc.gov/business-guidance

How VMS Supports Text-to-Pay for Small Businesses

VMS offers payment solutions that integrate text-to-pay functionality into existing merchant accounts and POS systems.

Support includes:

-

gateway configuration

-

secure payment link setup

-

POS and virtual terminal integration

-

reporting and reconciliation support

-

compliance guidance

Rather than using standalone apps, VMS focuses on integrating text-to-pay into a business’s broader payment ecosystem.

More information on VMS solutions can be found here:

➡️ https://www.getvms.com/payment-processing/

Best Practices for Implementing Text to Pay

To ensure success:

-

Use text-to-pay for appropriate scenarios

(deposits, balances, remote payments) -

Train staff on when and how to send links

-

Include clear descriptions in payment requests

-

Avoid overuse of SMS messaging

-

Monitor payment completion rates

-

Review failed payment alerts promptly

-

Ensure POS reporting matches collections

Proper implementation maximizes benefits and minimizes risk.

Common Mistakes to Avoid

-

Asking customers to text card details

-

Using non-secure links

-

Sending payment requests without context

-

Failing to reconcile payments properly

-

Ignoring SMS consent requirements

These errors undermine trust and create compliance exposure.

Final Thoughts: Text to Pay Is a Practical Tool, Not a Trend

Text to pay is not a novelty—it is a practical payment method that aligns with how customers already communicate. For small businesses seeking faster payments, improved cash flow, and reduced administrative effort, text-to-pay offers a clear advantage.

When implemented with the right payment infrastructure, text to pay becomes a reliable extension of your existing POS and invoicing systems.

If you are considering adding text-to-pay to your business, VMS can help evaluate compatibility, configure the solution correctly, and ensure compliance from day one.