Navigating the confusing world of merchant accounts can be stressful and difficult if you don’t know exactly what you need and don’t fully understand the terminology utilized by merchant account companies. Merchant account pricing schemes, along with the various credit card fees associated with merchant accounts, can be complicated.

Being aware of the different credit card fees, as well as the types of pricing schemes offered, can enable you to better spot a good deal and choose the merchant account provider that is right for your business.

How Are Credit Card Fees Determined?

It is important to understand that a transaction is not just a simple swipe of the card–there are many interactions that take place between you and the processing bank when a charge is being processed or another transaction is taking place, such as a charge refusal or reversal. Different types of businesses, the type of card being used, whether the card is charged manually, on credit card terminals, on a mobile device, or online payments are used, and other factors also all affect and typically result in credit card fees.

Before deciding upon any one credit card processing and merchant services provider, take the time to do your research. Get quotes, ask for complete details about all the fees you might incur, and learn more about the equipment you will be provided with. It is also important to determine what pricing scheme you will be using: tiered or cost plus pricing.

The Difference Between Tiered and Cost Plus Pricing for Credit Card Services

A merchant services provider often offers either cost plus pricing or tiered pricing for your credit card processing services.

Tiered pricing is based on the category a specific transaction falls into. A qualification matrix is used which factors the type of transaction and the type of card being used. The tier the transaction falls into determines your credit card fees for that particular transaction.

Cost plus pricing, also referred to as interchange plus pricing, is a bit clearer when it comes to figuring out credit card fees. Essentially, each type of card used has a specific fee associated with it, which is usually a specific percentage, plus a markup fee and transaction fee charged by the merchant services provider.

Choose a pricing scheme that best reflects your business model and the amount of transactions you normally process.

Customer Service and Equipment

In addition to credit card fees and pricing schemes, it is also important to work with a merchant services provider that delivers excellent customer service, as well as reliable and efficient equipment.

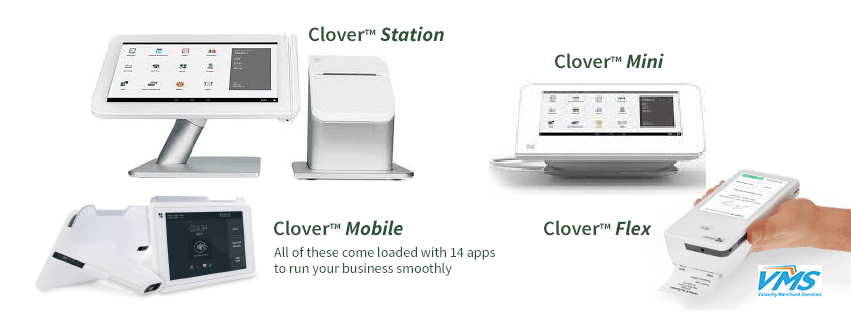

There are lots of options for your small business, and your equipment should be perfect for your business. The Clover POS can provide more personal time by freeing you up from the manual tasks that you do. Read more here and check out your options.

In conclusion, research is key, and the cheapest credit card processing provider isn’t always the best choice. Make sure that the merchant services provider you’ve chosen, as well as the pricing scheme, equipment, and processing services are right for your business needs.

At Velocity Merchant Services, your success is our passion. Envision where you want to be in the future, and we help you get there. Follow us on Facebook, Twitter, Instagram, Google+ and LinkedIn for ways to succeed in your industry.